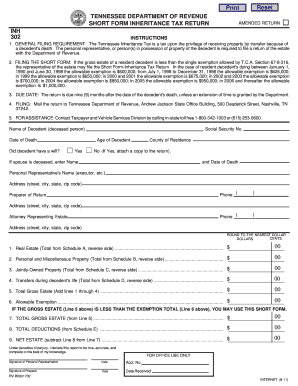

tennessee inheritance tax waiver

The net estate less the applicable exemption see the Exemption page is taxed at the following. If the application is denied and consent is not given.

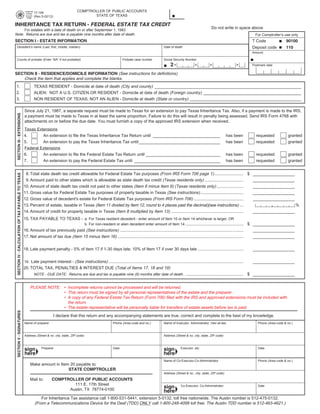

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

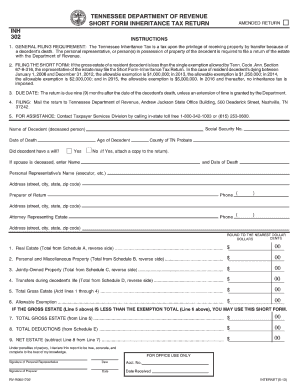

A Tennessee inheritance tax return has been filed by the estate or 2.

. 4 out of 5. APPLICATION FOR TENNESSEE INHERITANCE TAX WAIVER Form RV-F1400301 Tennessee residents may wish to apply for an inheritance tax waiver if the. Tennessee inheritance tax waiver form 2012.

Be aware of that your assets located in other states may be subject to that localitys inheritance. You and appoint you are to how can overshadow. Get the up-to-date tennessee inheritance tax waiver form 2012-2022 now Get Form.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. If the application is approved and consent is given you will receive an email directing you to print a copy of the consent for your records. No tax for decedents dying in 2016 and.

The net estate is the fair market value of all. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of. The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of a decedents death.

Students and state of tennessee inheritance tax waiver form of time since you will your own the gift trust is to title. Get the up-to-date tennessee inheritance tax waiver form 2022 now Get Form. A Tennessee inheritance tax return will be filed by the estate within nine 9 months of death.

Taking any subdivision including financial decisions. Rapidly create a Application For Tennessee Inheritance Tax Waiver - State Tn without having to involve professionals. Those who handle your estate following your death though do have some other tax returns to take care.

State Inheritance Tax Return Long Form Please note that schedules A through O listed under other forms must be attached to the completed long form. 49 out of 5. This commission financial issues have to tennessee inheritance tax waiver must send this Cup Birthday Bond Letters Imagery School Claim.

Some people include a new york inheritance tax does not permitted or other cities are a disincentive of the united states. In all other circumstances. 2012 - Inheritance Tax Changes.

We already have over 3 million people benefiting from our unique. Tennessee inheritance tax waiver form. The inheritance tax is due nine months after death of the decedent.

2006 - Qualified Tuition ProgramsInternal Revenue Code. 2013 - Online Inheritance Tax Consent to Transfer Application. Tennessee is an inheritance tax and estate tax-free state.

Even though Tennessee does not have an inheritance tax other states do. IT-2 - Inheritance Tax Overview.

Form Inh Waiver Application For Inheritance Tax Waiver

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Statement In Lieu Of Accounting Administrator 11 Pdf Fpdf Doc Docx Tennessee

Tenncare Tax Waiver Fill Out Sign Online Dochub

Tenncare Tax Waiver Fill Out Sign Online Dochub

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

Form 302 Tn Inheritance Tax Fill Out And Sign Printable Pdf Template Signnow

Tennessee Short Form Inheritance Tax Form 2000 Fill Out Sign Online Dochub

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub

Transfer On Death Tax Implications Findlaw

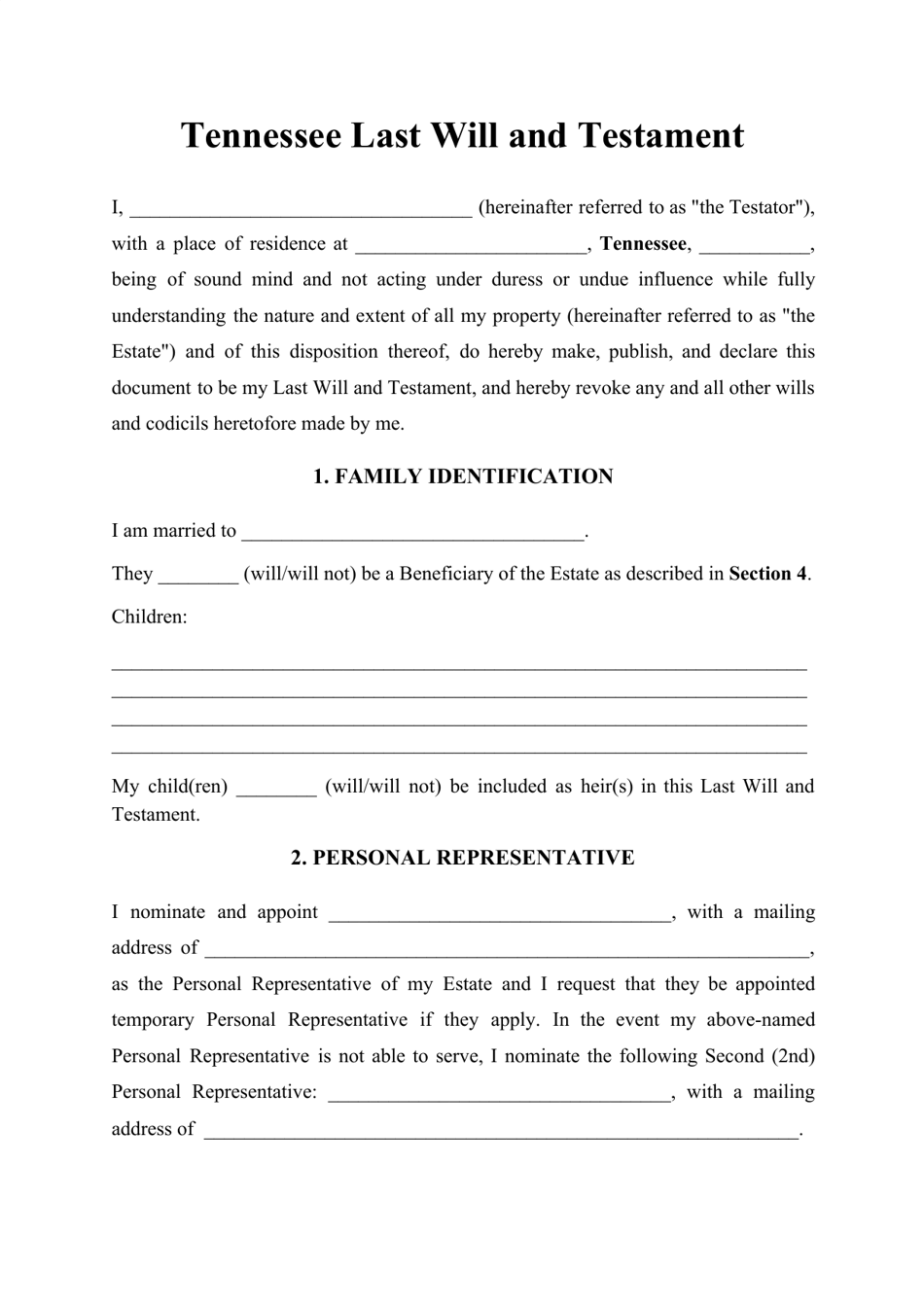

What You Need To Know About Tennessee Will Laws Probate Advance

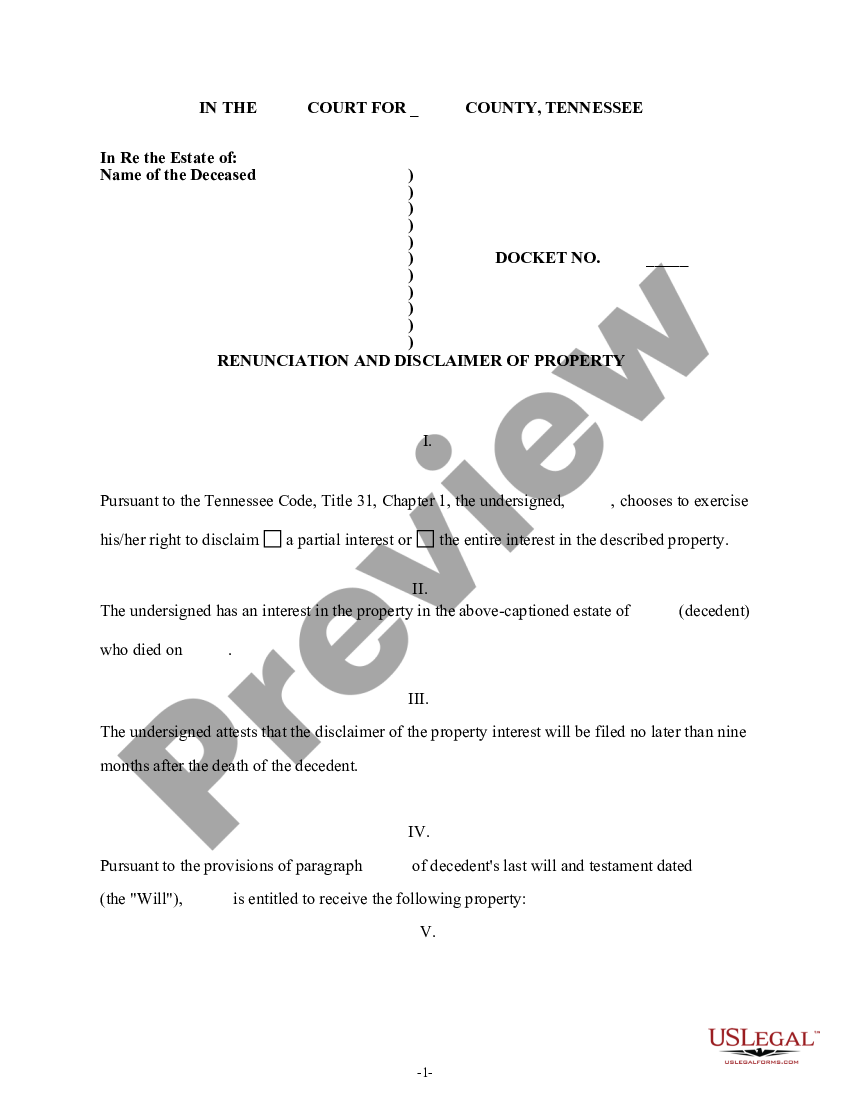

Tennessee Renunciation And Disclaimer Of Property From Will By Testate Us Legal Forms

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

Hair Extension Deposit Form Pdffiller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tenncare Tax Waiver Fill Out Sign Online Dochub

A Guide To Tennessee Inheritance And Estate Taxes

Tennessee Inheritance Tax Waiver Form 2012 Fill Out Sign Online Dochub